Indicators on Estate Planning Attorney You Should Know

Wiki Article

Some Known Incorrect Statements About Estate Planning Attorney

Table of ContentsThe Basic Principles Of Estate Planning Attorney Facts About Estate Planning Attorney UncoveredThe 10-Second Trick For Estate Planning AttorneyThe Basic Principles Of Estate Planning Attorney Our Estate Planning Attorney IdeasThe Basic Principles Of Estate Planning Attorney The Ultimate Guide To Estate Planning Attorney

An experienced attorney can offer useful support when managing assets during one's lifetime, transferring building upon fatality, and reducing tax obligation responsibilities. By asking such concerns, an individual can get understanding right into an attorney's certifications and identify if they are a good fit for their certain scenario. With this details, people will better understand how their estate strategy will certainly be handled gradually and what steps need to be taken if their situations change.It is recommended that people each year review their strategy with their lawyer to make certain that all papers are exact and updated. During this evaluation procedure, concerns regarding possession administration and taxes can additionally be attended to. By working with a skilled attorney that comprehends the requirements of their clients and remains present on modifications in the law, people can really feel confident that their estate strategy will certainly show their wishes and objectives for their beneficiaries if something were to take place to them.

A great estate planning lawyer ought to recognize the legislation and have a strong background in giving audio suggestions to assist clients make notified choices regarding their estates. When interviewing potential estate lawyers, it is necessary to request for recommendations from customers they have previously functioned with. This can supply valuable understanding right into their ability to develop and perform an efficient prepare for each client's special situations.

The 10-Minute Rule for Estate Planning Attorney

This might include drafting wills, trust funds, and other documents connected with estate planning, giving advice on tax obligation matters, or collaborating with other advisors such as monetary planners and accountants - Estate Planning Attorney. It is likewise a good concept to figure out if the attorney has experience with state-specific regulations or policies associated with properties so that all essential steps are taken when creating an estate planWhen creating an estate strategy, the size of time can differ significantly relying on the complexity of the person's situation and demands. To ensure that an effective and thorough strategy is developed, individuals need to take the time to locate the best attorney who is experienced and experienced in estate preparation.

The files and instructions developed during the preparation procedure become legally binding upon the client's fatality. A certified financial advisor, in conformity with the dreams of the deceased, will after that start to distribute count on assets according to the customer's guidelines. It is crucial to keep in mind that for an estate plan to be reliable, it has to be effectively applied after the client's death.

An Unbiased View of Estate Planning Attorney

The selected executor or trustee should make certain that all properties are dealt with according to legal demands and investigate this site in accordance with the deceased's dreams. This typically involves accumulating all documentation associated to accounts, investments, tax obligation records, and other items defined by the estate strategy. On top of that, the executor or trustee may require to coordinate with financial institutions and beneficiaries involved in the distribution of properties and various other issues concerning working out the estate.

People require to clearly comprehend all aspects of their estate strategy before it is propelled. Dealing with a skilled estate planning attorney can help guarantee the documents are effectively prepared, and all expectations are satisfied. On top of that, an attorney can supply understanding into exactly how various legal tools can be utilized to protect possessions and take full advantage of the transfer of wealth from one generation to another.

The 45-Second Trick For Estate Planning Attorney

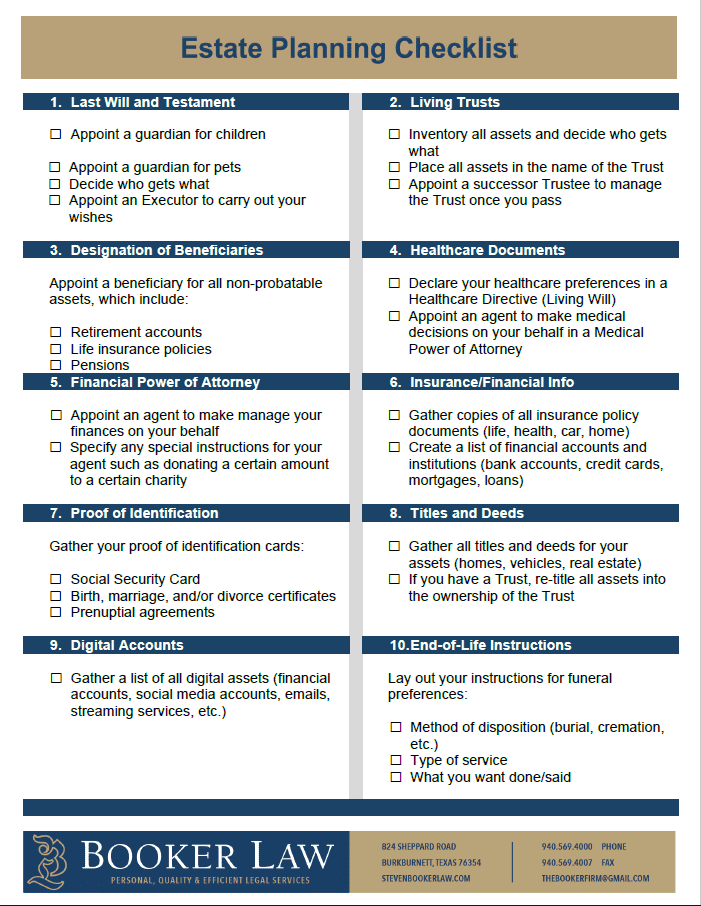

Inquire concerning their experience in managing complex estates, consisting of trust funds, wills, and various other records connected to estate planning. Figure out what sort of education and training they have gotten in the field and ask if they have any kind of specific expertise or qualifications around. Additionally, ask about any type of costs associated with their services and determine whether these costs are taken care of or based upon the work's intricacy.Estate intending refers to the preparation of tasks that handle a person's monetary scenario in case of their incapacitation or death. This planning includes the legacy of properties to beneficiaries and the negotiation of inheritance tax and financial obligations, along with various other factors to consider like the guardianship of minor children and animals.

Some of the actions include noting assets and financial debts, examining accounts, and writing a will certainly. Estate planning jobs include making a will, establishing up depends on, making charitable donations to limit inheritance tax, naming an administrator and beneficiaries, and setting up funeral setups. A will offers instructions concerning residential or commercial property and safekeeping of minor youngsters.

Estate Planning Attorney Fundamentals Explained

Estate preparation can and need to be made use of by everyonenot simply the ultra-wealthy. Estate planning includes establishing exactly how a person's properties will be preserved, took care of, and dispersed after fatality. It also takes right into account the management of an individual's residential or commercial properties and financial commitments in case they become incapacitated. Properties that might comprise an estate include residences, lorries, stocks, art, antiques, life insurance policy, pensions, financial debt, and much more.Anyone canand shouldconsider estate preparation. Writing a will is one of the most essential steps.

Review your retirement accounts. This is essential, particularly for accounts that have recipients connected to them. Remember, any accounts with a beneficiary pass directly to them. 5. Evaluation your insurance and annuities. Ensure your beneficiary info is up-to-date and all of official site your other details is exact. 6. Establish up joint accounts or transfer of fatality classifications.

The Ultimate Guide To Estate Planning Attorney

A transfer of fatality designation enables you to name a person who can take over the account after you die without probate. Choose your estate manager.8. Compose your check here will. Wills don't just untangle any type of financial unpredictability, they can likewise lay out prepare for your minor youngsters and pet dogs, and you can likewise instruct your estate to make charitable contributions with the funds you leave - Estate Planning Attorney. 9. Evaluation your papers. Ensure you look into whatever every number of years and make modifications whenever you see fit.

Send a copy of your will to your manager. This guarantees there is no second-guessing that a will certainly exists or that it gets shed. Send one to the individual that will think obligation for your events after you die and keep another copy someplace secure. 11. See a monetary professional.

Getting The Estate Planning Attorney To Work

There are tax-advantaged investment automobiles you can take advantage of to aid you and others, such as 529 university savings prepares for your grandchildren. A will certainly is a lawful file that gives instructions regarding how an individual's property and custodianship of small youngsters (if any kind of) must be handled after death.The will additionally shows whether a trust should be created after fatality. Relying on the estate proprietor's intents, a depend on can go into effect during their lifetime through a living trust fund or with a testamentary depend on after their fatality. The authenticity of a will is determined via a lawful process recognized as probate.

Report this wiki page